Content

The trial balance tallies all your debits and credits for the accounting period and makes sure they match up. Transfer the financial transactions from the general journal to the appropriate accounts on the general ledger with all detail. These transactions are usually recorded on a daily basis, and, as with general ledgers, you’ll have a credit and a debit for each entry. For example, let’s say you purchase some supplies that cost $50. When recording this purchase, you will use one of your expense accounts, since they represent money spent. If you purchased these supplies with money from your checking account, your checking balance is being reduced.

In a sense, a ledger is a record or summary of the account records. As discussed before, the financial entries are first recorded in a general journal. For example, goods purchased with cash will be recorded in the the general journal as a journal entry. The journal entry will debit goods as an asset and credit cash as it will be going out or reducing to purchase the goods. Financial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period .

You would record a debit in ‘cash’ and a credit in ‘accounts receivable’ in both the ledger and journal. The general ledger is not the only ledger in an accounting system. Subsidiary ledgers include selective accounts unlike the all-encompassing general ledger. Sometimes subsidiary ledgers are used as an intermediate step before posting journals to the general ledger. We have also provided the two accounts’ ledgers in which the journal entry will be posted. BookkeepingBookkeeping is the day-to-day documentation of a company’s financial transactions.

The model lets you answer “What If?” questions, easily and it is indispensable for professional risk analysis. Modeling Pro is an Excel-based app with a complete model-building tutorial and live templates for your own models. All legitimate business benefits belong in your business case or cost/benefit study. Find here the proven principles and process for valuing the full range of business benefits. “Allowance for Doubtful Accounts,” however, is a “contra asset account .” The purpose of this account is ultimately to reduce the impact “Accounts receivable” contributes to the asset base. The sub-ledger, moreover, may list information that does not go into the general ledger, but which is useful to sales managers.

Accountingtools

Debit your Expense account 1,500 to show an increase from the rent expense. Next, we’ll dive into a few other financial accounting documents that are closely related to — but distinct from — the general ledger. Revenue is the business’ income that is derived from the sales of its products and/or services.

The auditing field has moved away from process audits to risk based audits. To audit the general ledger, for example, you need to know your IFRs. To audit the treasury function, you need a good knowledge of financial instruments. An Internal Auditing degree does not offer these

— PhM (@MehlamiP) August 3, 2021

It follows that the sum of debits and the sum of the credits must be equal in value. Double-entry bookkeeping is not a guarantee that no errors have been made—for example, the wrong ledger account may have been debited or credited, or the entries completely reversed. The debit part of the above journal entry is “cash account” and the credit part is “sales account”. So the amount of the journal entry ($25,000) is written on the debit side of the cash account and credit side of the sales account. All journal entries are similarly posted to accounts in general ledger. A general ledger account is an account or record used to sort, store and summarize a company’s transactions. These accounts are arranged in the general ledger with the balance sheet accounts appearing first followed by the income statement accounts.

What Is A General Ledger, And Why Do You Need One?

We’ll discuss what they are, how and when to record them, and how they impact your nonprofit’s accounting system. If you have set up your nonprofit’s chart of accounts, and are ready to take the next step, this lesson is for you. In General ledger accounting, all the transactions are recorded in separate heads this helps in analysis and comparison with last year and accordingly, measures can be taken for the future. You just need to understand the fundamental principles of double-entry accounting, the basic accounting equation, and how to transfer journal entries to the ledger.

Rules, every financial transaction affects two accounts, causing them to either gain or lose something with equal amounts. Goods purchased with cash will cause goods to be debited as an asset while cash getting credited to finance the purchase. Double-entry bookkeeping is the most common accounting system for small businesses. It’s a way of managing your day-to-day transactions and stay on top of possible accounting errors. Every business transaction is recorded twice—once as money leaving an account and again as money entering an account . When you record a financial transaction, it’s called a journal entry, because bookkeeping has always been done by hand, in journals.

It Gives You One Place To View All Your Transactions

As a business owner, you juggle a number of tasks, including accounting. You’re responsible for creating journal entries after every transaction. You also need to know how to post journal entries to the general ledger. A trial balance is an internal report that lists each account name and balance documented within the general ledger. It provides a quick overview of which accounts have credit and debit balances to ensure that the general ledger is balanced faster than combing through every page of the general ledger. By this same analogy, a ledger could be considered a folder that contains all of the notebooks or accounts in the chart of accounts. For instance, the ledger folder could have a cash notebook, accounts receivable notebook, and notes receivable notebooks in it.

Difference Between Accounts Payable and Receivable – business.com – Business.com

Difference Between Accounts Payable and Receivable – business.com.

Posted: Tue, 09 Nov 2021 08:00:00 GMT [source]

Take control of asset TCO and prevent nasty cost surprises later. The financial hurdle rate event is familiar to nearly everyone in business seeking funding for projects, acquisitions, or investments. Free AccessBusiness Case GuideClear, practical, in-depth guide to principle-based case building, forecasting, and business case proof.

Small Business Ideas For Anyone Who Wants To Run Their Own Business

The goods being an asset will be debited after the purchase. On July 16, 2019, USA company sold goods to customers for cash $55,000. Can you please me to by an example i mean a full transaction and the general ledger please . I would like to know about declaring one account into another account and I heard this is sometimes done by taxation professional, they declare salary to procurement to be charged less. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

It’s an essential accounting record for creating financial reports which are crucial for evaluating business health. In reality, of course, the full chart of accounts, journal, and ledger will include many others not shown here. However, for one week’s activity affecting these accounts, the journal and ledger entries might appear as the following section shows. These accounts illustrate journal and ledger entries in the examples below. The bookkeeper or accountant dealing with journal and ledger entries faces one complication, however, in that not all accounts work additively with each other in financial accounting reports. In some cases, one account offsets the impact of another account in the same category. These are the contra accounts that “work against” other accounts in their categories.

They may be subdivided into sub-ledgers for more details such as cash accounts, accounts receivable, accounts payable etc. In accounting, a general ledger is used to record all of a company’s transactions. Within a general ledger, transactional data is organized into assets, liabilities, revenues, expenses, and owner’s equity.

Software Features

The financial statements are key to both financial modeling and accounting. A ledger is often referred to as the book of second entry because business events are first recorded injournals. After the journals are complete for the period, the account summaries are posted to the ledger.

Q : Accounts ?

A : In accounting, an account is a record in the general ledger that is used to sort and store transactions. For example, companies will have a Cash account in which to record every transaction… https://t.co/Elp1SOZMie— Syed Najaf Ishan (@iamsnih) January 12, 2020

While keeping a GL accurate and up-to-date takes effort, the return is real-time insights for the business. This quick guide walks you through the process of adding the Journal of Accountancy as a favorite news source in the News app from Apple. A random date in the PivotTable’s row labels, selected Group, and then selected the options to group the data by Years and clicked OK. As you can see, the resulting PivotTable report becomes far more readable and more meaningful, as shown in the screen shot “Grouping Data by Year.” Remove all unnecessary columns such as blank columns and columns containing information not pertinent to your final PivotTable. This is a straightforward procedure that involves selecting and deleting each unwanted column.

Assets normally have debit balances, for example, so brackets enclose a checking account’s balance only when the account is overdrawn. For example, on January 2, 2021, say you buy $4,000 worth of inventory with cash. Here is the general ledger entry with the corresponding journal entry.

Additionally, when you apply for a business loan, lenders will invariably ask for financial records to assess your credit risk. The general ledger gives lenders an idea of your debt-to-equity ratio and other important metrics. In the event that you are audited by the IRS, the general ledger makes it easy for you to prepare for the audit since you have your financial records in one place. Accounting software such as Freshbooks and Quickbooks enables you to create both a ledger and a journal and enter transactions at the same time using a single drop-down menu. The ledger is a more detailed breakdown of each account and its balance, so it is a running balance for each of your accounts. We won’t get further into the general ledger in this lesson, since bookkeeping software typically automates both the journal and ledger.

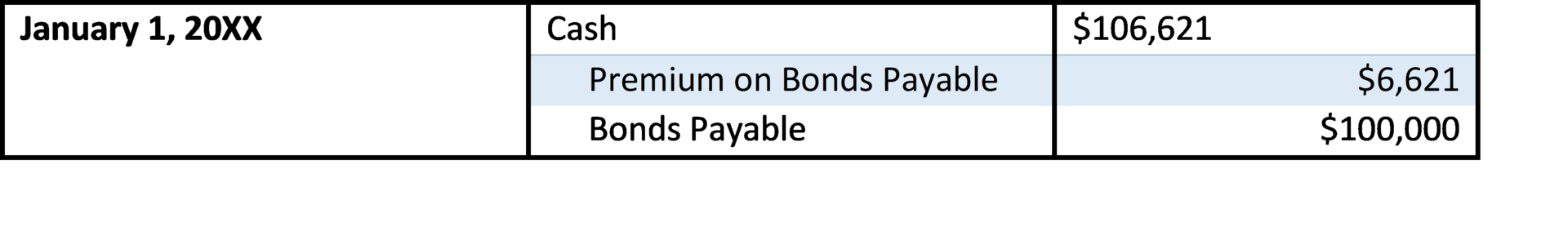

Journal Entries: Example

A general ledger also creates a comprehensive audit trail, which will be helpful if you ever get audited. Businesses use general ledgers as part of the accounting process. general ledger example Without a detailed general ledger, your accounting can quickly become disorganized and inaccurate. Inaccurate financial records cause significant problems down the road.

What are the two types of ledger?

General Ledger – General Ledger is divided into two types – Nominal Ledger and Private Ledger. Nominal ledger gives information on expenses, income, depreciation, insurance, etc. And Private ledger gives private information like salaries, wages, capitals, etc. Private ledger is not accessible to everyone.

Check out all Udemy has to offer for managerial courses today. Once you’ve identified the errors, adjust entries as needed to reconcile the correct balances. For example, if you have an account with a local contractor but do not currently owe them for services, that account will carry a zero balance.

He complete list of accounts that can appear for the organization’s journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list.

What is GL account type?

G/L Account Types

Account that is posted from business transactions. The balance of a balance sheet account is carried forward at fiscal year-end. Nonoperating Expense or Income.

As a busy business owner, you may not have much interest in basic accounting principles, such as maintaining a general ledger. While most accounting activities are best left to your accountant, it can be helpful to understand what a general ledger is and how it works.

- A manager reviews the balance sheet and notices that the amount of debt appears to be too high.

- Referencing the account’s number on the journal after posting the entry ensures that every line item that has a reference number in the journal has already been posted.

- As a result, the general ledger is the “top level” ledger.

- Use our research library below to get actionable, first-hand advice.

- In the event that you are audited by the IRS, the general ledger makes it easy for you to prepare for the audit since you have your financial records in one place.

As mentioned previously, software typically streamlines the journal and the general ledger. Software allows you to record the details of your transactions, while automatically keeping your account balances up to date. It also automatically compiles the information from your transactions into reports, which we will cover in the next lesson. In addition to the accounts used and the debit and credit values, the journal will also have information about the transaction. This additional information would be anything else relevant to the information you’re recording. For instance, using the above example of the $50 spent, it would be helpful to know the date of the purchase, where the purchase was made, and what was purchased with the recorded amount.

Author: Andrea Wahbe